Q2 Fertilizer Summary

KEY HIGHLIGHTS

Geopolitical volatility affecting all areas of the global fertilizer industry.

Israel-Iran conflict. 43.7 million tons of fertilizer and feedstock exports and 20-25% of the World’s oil exports transit through the Strait of Hormuz and the Persian Gulf.

Urea production disruptions in Egypt on a lack of LNG supply. Egypt traditionally exports over 4m tons of urea per year.

EU Tariffs on Russian and Belarussian fertilizers effective 1 Jul. 40-45 Euros per ton in 2025-26 and increasing every year afterwards.

China allows Urea exports from Jun-FH Oct (first exports since June 2023)

China DAP export window opens from June-Sept

Three Indian Urea tenders during the quarter

China/India standard MOP contract settlement at a substantial price increase (23%+) from 2024

Sharp weakness in the U.S. Dollar and continued tariff uncertainty

Ukraine drone strikes drone hit EuroChem’s Nevinnomyssk fertilizer plant, causing production disruptions

7.7 Magnitude earthquake hit Myanmar on 28 March

India and Pakistan conflict over 22 April terrorist attack and 7 May counterattack

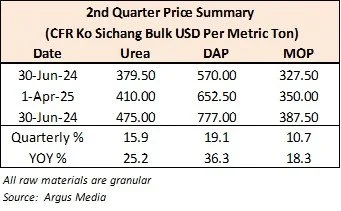

Urea: Prices continued to increase from the 1st quarter, soaring 16%.

DAP: Prices firmed 19% in the quarter on tight supply and healthy demand.

MOP: Prices remain affordable but increased 11% for the quarter

Sulphur / Sulphuric Acid: Prices remained very firm over geopolitical tensions between Israel/Iran. China, India and Morocco will be primarily affected as the main buyers of Sulphur from the region.

Freight Rates: Container shipping rates from China remain elevated with supply chain delays of 2-4 weeks common.

The Thai Baht ended the quarter strong at/around 32.2 Baht/USD.

Volatility Rules the Quarter

Double digit price increases for all raw materials

UREA

Urea ended the quarter up 16% to $475 CFR and up 25% year over year. Local wholesale prices ended the quarter at around 15,500-15,800 Baht per metric ton in bulk ex-warehouse.

The quarter began on a firm note over U.S. tariff uncertainty for Urea producing countries like Algeria (30% tax proposed) and Nigeria (14% tax proposed) and shortages of gas supplies in Egypt. India issued a tender for 1.5m tons on 8 April and bought 885,000 tons at $385 CFR (West Coast) and $398.24 (East Coast). Speculation on China permitting Urea exports and India not securing the full 1.5m tons contributed to market uncertainty.

Thai and SE Asia buying picked up after Songkran, with good rains anticipated for the main season. China officially opened Urea exports from June through 15 October for the first time since June 2023, however, exports to India remained restricted. Healthy demand from India, Ethiopia, Australia and Latin America kept the market stable through May.

On 12 June, India tendered another 1.5m tons. India’s Urea stocks at the end of May were historically low (down 34% from 2024). Geopolitical escalation peaked mid-June, with Israeli and U.S. strikes on Iran, sparking a $100/ton jump in Urea FOB values across several markets. Due to the conflict, only 229k tons were booked on the 12 June India tender with a follow-on tender expected in July.

Urea prices ended the quarter firm. The urea market direction is volatile, but will likely trend according to the next India tender results expected 8 July.

DAP

DAP prices remained elevated in the 2nd quarter. The price of DAP increased 19% in the quarter and 36% year over year to the $775-$780 CFR level. Local wholesale prices increased to 25,800 – 25,900 Baht per metric ton at the end of the quarter.

The big news was China’s decision to open the MAP/DAP export window from June-Sept. Cargoes with CIQ approvals by the end of September are expected to be approved for customs clearance and export. Exports to India, however, were still restricted which helped Thailand secure much needed tons. Demand from Ethiopia, SE Asia and Pakistan was healthy in the 2nd quarter.

SE Asia DAP prices were priced at a discount in the 2nd quarter to India CFR prices, which is unusual because of India’s significant phosphate volume. The Department of Fertilizers in India hoped to maintain a purchase ceiling at $700 CFR, but by the end of the quarter were purchasing at $790-$800 CFR.

Geopolitical tensions continue to present challenges for phosphate exporters who transit the Red Sea and the Suez Canal. Increased freight costs and transit times are affecting most exporters.

The DAP market will remain firm, especially as China is expected to restrict exports after September and other supply options are limited. Affordability and demand destruction are areas of concern.

MOP

Granular MOP prices increased 11% from the end of the 1st quarter and 18% year over year. Local wholesale prices ended the quarter at 13,400-13,800 Baht per metric ton for non-Laos origin and 12,400 per metric ton for Laos MOP. Thai Oil Palm FFB prices remain depressed which is marginally affecting demand.

China agreed to new contracts for standard grade MOP at $346 CFR for the remainder of 2025. India concluded at $349 CFR with 180 days credit. Annual contracts with India and China increased $66 per ton and $73 per ton, respectively, from 2024.

Geopolitical risk from the Israel-Iran conflict has affected MOP export deliveries from Dead Sea Works (Israel) and Arab Potash Corporation (Jordan). Most importers are having difficulty securing all the MOP tons required.

MOP prices will continue firm with little downside due to limited availability, supply chain issues and healthy demand.

Volatility in the Short Term

A Picture says 1000 Words. Great Infographic. Short-term volatility for sure.

Thailand will be affected. In 2024, fertilizers imported from the Persian Gulf:

• 1.3m tons from Saudi Arabia

• 414k tons from Oman/Iran

• 238k tons from Qatar

• 80k tons from Bahrain

and from the Red Sea:

• 111k tons from Jordan

• 97k tons from Israel

and corresponding ripple effects:

• Higher sulphur and ammonia costs

• Higher freight costs and supply chain disruptions

• Higher prices across product lines and origins

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

A Learned Discipline

A heartfelt thank you to Associate Professor Dr. Naroon Varamitr (ผู้ช่วยศาสตราจารย์ ดร.นรุณ วรามิตร), Dean of the School of Integrated Sciences at Kasetsart University, and the KU faculty for the kind invitation to speak to the incoming class about entrepreneurship.

My talk focused on some of the key principles behind entrepreneurial success — especially the importance of not being afraid to fail.

I’ve been fortunate to learn from so many inspiring people throughout my journey. It was a real pleasure to share some of those stories and lessons with the next generation of entrepreneurs.

Thailand Presents MOP Opportunities

On 16 June 2025, the Faculty of Mining and Natural Resources at Chulalongkorn University and the Ministry of Industry delivered the culminating presentation of a six-month research initiative examining Thailand’s three major potash (MOP) projects.

The comprehensive study reviewed mining feasibility, economic potential, and strategic opportunities tied to domestic and export-sales of MOP and corresponding bi-products. With substantial reserves and rising regional demand, Thailand has the potential to be an important player in the Southeast Asia potash market.

Ms. Thanchanok (Air) Suwanprasert, Vice President of the Thai Fertilizer Producer and Trade Association (TFPTA) and Managing Director of Chewachem Ltd, attended as an industry representative.

Q1 Fertilizer Review

KEY HIGHLIGHTS

Urea: Prices continued their increase from the fourth quarter in anticipation of large buying from India. Prices peaked in February at $455 CFR before falling in March.

DAP: Tight supply as no exports were approved from China in the first quarter.

MOP: Prices remain affordable, but all suppliers are increasing prices for the second quarter.

Sulphur: The price increased over 150% in the quarter and over 700% year-over-year, partially because of high DAP/MAP prices. This impacts all fertilizers using sulphuric acid.

U.S. Dollar: Concerns across commodity markets about tariffs proposed by the new administration and when they will become effective.

Irrigation Water: water volumes are ahead of 2024 levels and remain healthy according to the Thai Royal Irrigation Department

Freight Rates: Container shipping costs from China eased from the 4th quarter but remain elevated ($38-$40 pmt from N. China).

Raw materials remain firm. Global uncertainty continues.

UREA

Urea ended the quarter up 2.6% to $395 CFR. Prices were as high as $455 CFR at the end of February. Local wholesale prices ended the quarter at around 15,000 Baht per metric ton in bulk ex-warehouse.

The quarter started strong in anticipation of a new Indian tender for 1.5m tons for loading by 5 March. The winning offers were $427 pmt CFR east coast and $422 pmt CFR west coast, but only 500k tons were accepted. Production from Iran was also severely reduced on limited gas supplies for most of the quarter. India’s inventories remain seasonally low. Most anticipated another tender in February, but when it did not materialize until the end of March, prices fell.

On 26 March, India announced a tender for 1.5m tons with results to be announced on 8 April for loading by 12 June. The results should set the mood for the 2nd quarter. Buying is expected to pick up in April in Thailand after Songkran ahead of the main application season. Sabic loaded four urea vessels and Bahrain and Petronas each loaded one urea vessel for Thailand at mid/end of March. China continues to be absent from the urea export market. Pending the Indian tender results, supply should be tight.

The urea market will most likely trend sideways for the second quarter

DAP

DAP prices remained elevated in the 1st quarter. The price of DAP increased 1.2% in the quarter to the $650-$655 CFR level. Local wholesale prices surged to 25,200 – 25,400 Baht per metric ton at the end of the quarter.

There was steady DAP demand from India and Ethiopia and much of the demand was filled by Morocco, Jordan, Saudi Arabia and Russia. Most of the Thai demand is being filled by Phosagro (Russia) and SABIC/Ma’aden (Saudi Arabia).

The story continues to be the lack of supply from China due to the export ban on MAP/DAP. The Phosphate Association is expected to meet 23-25 April to decide when to export policy. Most expect DAP exports will resume at the end of May after China’s main season is finished.

The EU has proposed additional tariffs on Russian MAP, DAP, NPK, NP and NK of 40 Euros per ton from 1 July 2025 on top of the 6.5% current import duty and raising them each year onwards. It is not clear if the resolution will be approved.

The DAP market will remain firm until China resumes exports. Demand is healthy.

MOP

Granular MOP prices have bottomed in January and have started to increase with healthy demand from Brazil. Prices at the end of the first quarter were up 7.8% to around the $340-$345 CFR level. Local wholesale prices ended the quarter at 12,300 Baht per metric ton for non-Laos origin and 11,800 per metric ton for Laos MOP.

The international banking / SWIFT sanctions against Belarus and Russia, have caused several Thai buyers to switch to Jordanian MOP for ease of import. There are concerns around the threat of U.S. tariffs and the uncertainty around the treatment of fertilizers. Canada supplies over 12 million tons or 85% of U.S. potash and 25% of U.S. nitrogen fertilizers. There currently is a pause on most new tariffs for a 90-day period though the policy as well as the exempt items are not yet clear.

Suppliers are actively trying to increase prices, and the trend will continue in the 2nd quarter. Both Russia and Belarus are cutting production and Nutrien is fully committed for the first half of 2025.

Standard grade MOP contracts for China and India will most likely be settled in April and will further tighten supply once agreed. MOP prices will continue firm with little downside.

#fertilizer

Short Positions in Fertilizer Trading

‘Going long’ is straightforward, but taking a short position comes with added complexity and risk—especially in the fertilizer market, where counterparty default is a real concern.

‘Going short’ means selling first and then buying later for delivery—ideally at a lower price. Even if you never deliberately take a short position, you will inevitably have to manage short exposures in some form:

Selling a back-to-back bulk cargo? You’re short freight.

Buying and selling in different currencies? You’re short currency (you’ve sold at an exchange rate and are hoping to cover at a more favorable one).

When selling short in the physical fertilizer markets, several key factors come into play:

• Contract Performance – Both you and your counterparty must fulfill contract terms. If the market moves against you, you must still cover your short and deliver at a loss. Likewise, your buyer must take delivery even if prices move against them.

• Reliable Supply – Having accessible, trustworthy suppliers is crucial when it's time to cover your short position and meet customer commitments. Also, you must ensure that any supplier you buy from meets the customer’s requirements.

• Market Knowledge – Understanding price trends, supply conditions, freight rates, and potential supply chain disruptions are crucial especially since hedging options are limited.

• Time is Your Friend – The more time you have, the better positioned you are to manage price fluctuations, secure supply, and fulfill contract obligations.

Short positions carry many inherent risks, but with the right strategy and market conditions, they can add a valuable tool to your trading business.

Happy trading!

#Trading #Fertilizer #RiskManagement

Q4 Fertilizer Review

KEY HIGHLIGHTS

• Urea: Prices increased sharply at the end of the quarter and are expected to remain firm into the new year.

• DAP: Tight supply from China has kept prices elevated, driven by an export ban from 1 Dec 2024, which is expected to continue through Q1 2025.

• MOP: Prices remain stable and affordable relative to Nitrogen and Phosphate. Supply remains ample and prices are stable to firm with little downside risk.

• U.S. Dollar: Strengthened following Donald Trump’s election victory. There are concerns in the commodity markets about potential tariffs under the new administration.

• Natural Gas: Dutch TTF natural gas prices ended the year at around $14.50 MMBtu, the highest level in 2024, but in line with historical averages.

• Heavy rains and flooding in Thailand curtailed demand in the 4th quarter.

• Freight Rates: Container shipping costs from China remained elevated in the fourth quarter ($45-$55 pmt from N. China).

• Commodity Prices:

- Palm oil rose 18% to approximately $1,000 USD/ton

- Sunflower and rapeseed oil prices significantly increased

- Rubber prices surged 25% to $1.90 per kg

DAP prices remain at a historically wide premium to Urea and MOP

UREA

Urea ended the quarter down 4% at the $385 CFR level, but up 8% year over year. Local wholesale prices ended the quarter at 13,500-13,700 Baht per metric ton in bulk ex-warehouse.

There were three much anticipated Indian tenders during the quarter which supported urea prices. West Coast India ($364.50, $362, $369.75 CFR) and East Coast ($389 CFR). India’s inventories remain seasonally low because of strong demand and good rains. Additional Urea buying tenders from India (19 Dec, 1.5m tons) and Ethiopia (23 Dec, 821,000 tons) helped support prices at the end of the quarter.

The 4th quarter is typically slow for spot buyers of urea in Thailand. China continues to be absent from the urea export market. Gas supply issues limited exports from Iran. Regular buying in SE Asia should resume in January.

DAP

DAP prices remained stable but elevated in the 4th quarter. The price of DAP increased 4% year over year to around the $645 CFR level. Local wholesale prices traded around 22,500-23,000 Baht per metric ton at the end of the quarter and are anticipated to increase further on limited supply.

In 2024, DAP traded at a historically wide margin to Urea prices. Taking out the supply disruptions from Covid-19 and the start of the Russian/Ukraine conflict, DAP prices are trading 45% above their adjusted historical average ($426 FOB).

There was steady DAP demand from India and Ethiopia. Most of the Indian demand was filled by OCP and Ma’aden as China limited exports to India.

Hurricane Helene and Milton significantly impacted phosphate production from Mosaic and Nutrien in Florida. Additionally, the Port of Tampa, responsible for 40% of U.S. phosphate fertilizer exports, faced closures which further tightened the phosphate market.

On 1 Dec, China announced a halt on Customs inspections (CIQ) for MAP/DAP. The export ban is expected to last through the first quarter of 2025. Even CIQ approved shipments in November were not permitted to clear customs. At least two CIQ approved cargoes destined for Thailand were cancelled. This will put further pressure on local pricing in the 1st quarter. NPS and NPK shipments are still approved for export.

There is not much upside in the DAP market, but supply issues will keep the market firm.

MOP

Granular MOP prices were mostly stable around the $315-$320 CFR level. MOP prices were down 12% in 2024. Local wholesale prices ended the quarter at 11,900 Baht per metric ton for non-Laos origin and 11,200 per metric ton or Laos MOP.

Thailand imported 830,992 tons of MOP, up 24%, from Jan-Nov. Canada, Laos and Belarus together accounted for roughly 75% market share.

Labor disputes in key Canadian ports were resolved in November. Vancouver is Canada's busiest port and facilitates exports of potash for Southeast Asia.

Belarussian Potash Corporation (BPC) has hinted at decreasing production to increase MOP prices. BPC is operating at 90% capacity and is fully recovered from the initial shocks of losing the port at Klaipeda and the fallout from international sanctions. Thailand imported 147,000 tons from BPC from Jan-Sep. Uralkali and Eurochem MOP export volumes have also fully recovered.

China standard grade MOP contracts ($270 - $273 CFR) and India ($283 CFR with 180 days credit) are expected to increase next year. MOP prices should remain firm with very little downside.

Can Bangchak Compete in S.E. Asia’s Growing Potash Market?

Thailand's high-quality potash deposits hold enormous potential, but development has faced significant hurdles. Operational costs, environmental challenges, and logistical hurdles have slowed development. Additionally, the global market for potash is competitive. Legacy producers have significant cost advantages.

Laos-based producers benefit from lower production costs, strong Chinese investment and proximity to the Thai market. Sino-Agri Potash (Sino KCL) in Laos have increased their market share in Thailand from less than 5% in 2019 to 22% in 2024 (187,200 tons). They plan to increase their capacity from 2 million tons to 5 million tons per year by 2025/26 and eventually to 10 million tons per year.

The other major potash player in Laos, Lao Kaiyuan currently has a capacity of 1 million tons and plans to double that by the end of 2025. Three other ongoing projects near the Laos capital of Vientiane are funded with Chinese investment: Sino Hydro Mining (2.5m mt/year), Ruiyuan Richfield Sylvine Sole (500k mt/year) and Zangee Mining (2.0m mt/year).

Two other undeveloped MOP projects in Thailand (Chaiyaphum and Udon Thani) are currently being reviewed. Reuters recently reported that China’s SDIC (the largest SOP producer in the World) was looking to acquire 49% of the MOP mine in Udon Thani, Thailand.

While Laos-based producers are growing rapidly, global giants like Eurochem and BHP are also increasing capacity, adding pressure to an already competitive market.

Bangchak’s success will ultimately hinge on its ability to manage development and operational costs and make a profit at market prices. Potash demand will be there.

Bangchak Invests in Thailand’s Potash Potential

Article: Bangkok Post, 17 Dec 2024, B2

U.S. Farmers Struggling

Some key takeaways from a recent article in Barrons titled, “U.S. Farmers Are Struggling. They Will Lose More in a Trade War, [according to Dan Basse, CEO of AgResource].”

1. Declining U.S. Agricultural Dominance:

• U.S. share in global agricultural trade dropped from 62% in 1979 to 11% today and the trade deficit is at a record $42 billion.

• Brazil now leads in soybean and corn exports, surpassing the U.S.

2. Impact of Geopolitical Shifts and Trade Wars:

• The divide between G-7 countries and BRIC nations is altering trade patterns at the expense of U.S. farmers.

• China's pivot away from U.S. agricultural imports benefits Russia, Brazil, and Argentina.

• Potential retaliation from U.S. import tariffs on China, Mexico, Canada, and other trade partners.

3. Economic Pressures on Farmers:

• Corn and soybean production costs are below current futures prices. “Net farm income has dropped by 31% since 2022, marking the largest two-year decline on record.”

• High fertilizer and seed costs, further squeeze farmer profits. Fertilizer costs continue to be affected by a volatile global supply chain and energy market. Additionally, 30% of U.S. farmers rent their land.

• USDA data reports that 85 cents of every farm dollar goes to the middlemen (processing, packaging, and transportation).

• Beef producers benefit from record-high prices ($8.50/lb), partially supported by innovations in dairy-beef crossbreeding; “The first time the dairy industry is helping the beef industry get additional supply.”

Space Testing vs

Soil Testing

4. Future of U.S. Agriculture:

• Enhanced understanding of soil and soil fertility should be a critical focus, leading to my favorite quote from the article:

“As I watch Elon Musk land spaceships, I think, we know more about what is 200 miles above our heads than what is two feet under our shoes.”

Well said Dan!

#fertilizer #AgResource

(Source: “U.S. Farmers Are Struggling. They Will Lose More in a Trade War, This Ag Expert Says”, Debbie Carlson, Barrons, 28 Nov 2024)

Tariffs are All the Rage

On the 21st of November, EU Trade Ministers met to mull additional tariffs for agricultural and fertilizers from Russia and Belarus into the EU. This certainly has raised some questions over practical implementation and whether the current sanctions are serving their intended purposes.

The U.S. Department of Commerce has set countervailing duty (CVD) rates on phosphate fertilizers from Morocco (16.81%) and Russia (17.20%) to assist U.S. phosphate producers. For ammonium sulphate from China, rates are even more penal: antidumping duty (AD) of 493.46% and countervailing duty (CVD) rate of 206.72% (federalregister.gov).

In 2018, China cut the NPK export tax from 20% to 100 Yuan/metric ton and then in 2019, they waived the export tax all-together on many fertilizers including NPKs. NPK exports predictably soared (over 700% in 2018).

Export Taxes - Effective?

The reduction in 2018 and subsequent removal in 2019 of the China Export Tax on selected fertilizers had significant effects on exports.

Tariffs are a very complex issue. One can trace each step of the fertilizer supply chain from the mine, processing, importation, re-processing, packaging, shipping, distribution, retailing and finally to the end farmer applying in the field.

People working at every stage in the supply chain will have differing opinions. But honestly, I haven’t met too many farmers wanting to pay more for higher farm input prices. There is certainly ardent debate on both sides of the tariff issue. In general, they are protectionist measures in one way or another.

The Thai agricultural fertilizer market has no import tariffs on most chemical fertilizers, which makes for an interesting case study. Are tariffs achieving their goals of protecting domestic producers and ensuring market fairness, or are they creating unintended consequences across global supply chains?"

Maybe that should be 'All the Rage' !

Power of Distribution

Distribution is a major reason behind any company’s success or failure. Devising the best strategy to reach your target customers is paramount. I found the recent Bangkok Post article very thought-provoking on Temu’s strategy in Thailand.

https://www.bangkokpost.com/business/general/2841612/upsetting-the-apple-cart

Fertilizer distribution varies in each country depending on the regulatory environment, arable land, infrastructure, population, the geographic size and location and the availability of raw materials. Many factors in distribution will contribute to the cost and availability of fertilizers at the retail level including the heavy and bulky nature of the product.

Quality, service and brand are also important, but none of that matters if the product isn’t readily accessible and affordable. Could a Temu type strategy work in the fertilizer industry? Good question.

Q3 Fertilizer Review

DAP prices remain firm and uncorrelated with Urea

and MOP price declines

Urea prices were stable ending the quarter up 1.4% on a bounce from the latest Indian tender.

DAP remained firm increasing 11% for the quarter and 35% year over year on limited supply.

MOP drifted weaker and is forming a bottom.

The Thai Government’s 29.5 billion Baht rice program was put on hold and will be studied further before implementation.

Thai Baht strengthened 11% from 36.8 to 32.8 THB/USD in the 3rd quarter. This will help reduce import prices in the fourth quarter.

The flooding in Chiang Rai, Lampang and Phitsanulok in the North; Nong Khai and Nakhon Phanom in the Northeast; and Ayutthaya in the Central Plain has curtailed fertilizer demand.

The conflict in the Middle East and Ukraine continues to add uncertainty to the supply chain.

Global container freight rates have eased a bit from the second quarter and bulk freight rates have been relatively stable,

China continued to restrict Urea exports and did not export in the 3rd quarter.

Natural Gas disruptions in Egypt have stabilized from the 2nd quarter.

Agricultural commodities posted a strong recovery from July and August weakness. Palm Oil prices are at roughly $950 USD/ton, a level not seen since April.

The regional Asian fertilizer conference is being held 8-10 October in Hong Kong

UREA

Urea ended the quarter around the $385 CFR level up 1.4% for the quarter and down 2.5% year over year. Local wholesale prices ended the quarter at 12,900-13,100 Baht per metric ton in bulk ex-warehouse.

Urea prices drifted lower in July and August on lackluster demand as the market waited for another Indian tender. On 29 August, NLF tendered for 1.13m tons of urea for shipment ending October. Winning offers were $340 CFR West Coast and $349.88 East Coast representing an average decline of $14 per ton from the tender in July.

A subsequent tender was issued 19 September with shipments by 20th November. Price and quantities will be announced on 3 October and could set the price direction in the fourth quarter. India’s expected demand is 2-2.5m tons as inventories are seasonally low and good rains in the monsoon season have kept demand firm.

Thailand urea imports from Malaysia were down 39% on increased supply from Brunei, Indonesia and Oman. China did not export urea in the 3rd quarter instead keeping for domestic consumption and is unlikely to export in the 4th quarter.

DAP

DAP prices increased in the 2nd quarter 11% to $635-640 CFR. Year over year, DAP prices have increased 35%. Local wholesale prices traded around 22,500-23,000 Baht per metric ton at the end of the quarter.

DAP began the quarter at $575 CFR and continued firm on tight supply and limited demand from India. India bought at $550 CFR in first half July and ended the quarter buying in the $630’s CFR level. India delayed purchases in the hopes of price declines as the current subsidy makes buying at these levels unprofitable for importers. Production of DAP (down 15%), import (48%) and sales (11%) were all down in the second quarter respectively. India, Pakistan and Bangladesh eventually were forced to buy at higher price levels as their inventories drew down.

CIQ inspections in China are now taking up to 4 weeks for export approval. DAP prices are expected to remain stable to firm even as demand is typically weak in the fourth quarter in SE Asia.

MOP

Granular MOP prices were mostly stable around the $320-$330 CFR level. Year over year, MOP prices were down 13%. Local wholesale prices ended the quarter at 12,100 – 12,300 Baht per metric ton down about 800 Baht per ton for the quarter. ICL increased their standard grade contract price with an India importer $6 pmt to $285 CFR. This may indicate a market bottom.

Uralkali appears set to enter the Thai market directly and sell both wholesale and retail in their brand. Along with MOP from Laos, this will put further pressure on retail MOP prices.

There is still a large disconnect between SOP and MOP prices. With SOP exports restricted from China, supply of granular is very tight in S.E. Asia. SOP has come down $20-30, but still trades around $650 - $660 CFR from Vietnam/Taiwan.

MOP prices should remain stable as dealers try to maintain their current prices and the CPO price remains strong.

A fun look at inflation

Are today’s inflation-adjusted prices affordable?

Tickets to the 1975 World Series Game – Game 6: Price $7.50

This game is always mentioned as one of the greatest games in World Series History.

Four-Day Pass to the 1985 Masters: Price $75

Bernhard Langer won and all Top 10 finishers are in the PGA Hall of Fame.

Tickets to the 1991 World Series: Price: $45.

Most Braves fans prefer to remember 1995.

Standard Grade Muriate of Potash (MOP), FOB Vancouver in USD.

February Price Levels:

1988 ($88pmt)

1998 ($125pmt)

2008 ($375pmt)

2018 ($230pmt)

2024 ($240pmt)

Source: Argus Media.

Excluding the extreme events in 2008, Covid-19 and the geopolitical disruptions in 2021-2022, MOP has increased about 3.5% per year, generally in line with inflation. If all the other events above had a similar 3.5% inflationary increase, prices might still be very reasonable for the average fan:

A World Series ticket at Fenway Park today would cost approximately : $52

A Four-Day Pass to the 2024 Masters : $287

A World Series ticket to see the Braves win in 2024 : $140

Conclusion: Potash at $240 seems quite affordable.

Separating the Noise from the Song?

Separating the Noise in Commodities

A friend sent the attached graphic, and it made me think of all the noise in the commodity industry and how it affects fertilizer prices. How do you separate what is important when buying fertilizer?

“And you may ask yourself, ‘How do I work this?’ “

Annual standard-grade MOP contracts are settled with China and India

Egyptian gas shortages and Indonesian ammonium sulphate tenders

India’s latest Urea/DAP tender/demand. Right amount? Right price?

China. Imports vs Exports vs Domestic Consumption

Exorbitant container freight costs

Product quality and consistency issues

Production rates and turnarounds

In-season vs Out-of-season

World Supply vs World Demand

Crop Price Volatility. Corn vs Beans

Natural Gas, Ammonia and Oil Prices

Floods, fires, monsoons and droughts

Wars, sanctions, tariffs and global supply chain disruptions

Interest rates, exchange rates and financing issues

“And you may ask yourself, ‘Am I right, am I wrong?’’”

In many ways, predicting fertilizer prices is like predicting the flow of water, it goes where it wants to go, to the path of least resistance until there is sufficient pushback.

“And you may ask yourself, ‘Well, how did I get here?’“

Fertilizer prices will rise until they can rise no more. They will decline until the downward trend is finished. The water doesn’t care why the dam broke. It is always perfectly explainable after the fact, but very dangerous to fight the trend. Complexity is a certainty.

So where are prices headed now?

Quotations: ‘Once in a Lifetime’ by Talking Heads

Q2 Fertilizer Review

Q2 Fertilizer Review

Urea and DAP prices were very volatile during the quarter, while MOP prices were mostly stable.

The conflict in the Gaza Strip continues to cause cargo delays and alter trade routes.

The conflict between Ukraine and Russia continues to affect world freight and insurance markets and MOP trade routes.

Global container freight congestion has caused freight rates to increase 2-3x in the quarter. Container freights from China to Thailand have hit two-year highs. $1,500 per TEU from North China and $900-1000 per TEU from Central China.

China continues to halt Urea exports at least until August.

Natural Gas disruptions in Egypt have created supply disruptions in the Arab Gulf.

Agricultural commodities including Corn, Wheat, Soybeans and Palm Oil had a weak 2nd quarter. Wheat dropped 18% in June.

UREA

Urea ended the quarter around the $380 CFR level up 3.8% for the quarter and up 17% for the year.

Urea prices started the quarter with an Indian tender commitment of 724,000 tons at $347.70 - $339 per ton CFR. The tender was subsequently reduced to 340,000 tons which exacerbated the downtrend that would continue for the next 45 days, reaching $320 CFR in mid-May.

The market reversed after Egyptian producers cut output due to worries about national gas supplies. Urea prices finished the quarter up $60 per ton as Egypt was forced to close all Urea plants.

The quarter ended with Indian Potash Limited (IPL) issuing a tender closing on 8 July with offers valid until 18 July for delivery up to 27 August. Purchase estimates are in the 500,000-1,000,000 tons range. India has approximately 10.5m tons in stock and consumes about 36m tons per year.

There is still uncertainty about whether China will export urea in the 3rd quarter or keep for domestic consumption.

DAP

DAP prices declined slightly in the 2nd quarter 2.6% to $570-$575 CFR. Year over year, DAP prices have increased 25%.

DAP began the quarter softening to around the $530 CFR level but firmed to end the quarter with strong demand in S.E. Asia. India and Pakistan have low phosphate inventories compared to last year, but India is reluctant to pay the current CFR prices. The breakeven cost for Indian DAP importers is around $510 CFR based on the subsidies and maximum retail price (MRP). Demand for high P2O5 NPK grades in India may increase due to the high price of DAP.

In Thailand, cargo from Phosagro, OCP, Maaden and various Chinese producers arrived for the main season. DAP was reportedly purchased around the $575 CFR level for end-July shipment. CIQ inspections in China are now taking 2-4 weeks.

The DAP price is expected to remain stable throughout the third quarter with Indian demand and overall affordability expected to pressure the price downwards. The pending Bangladesh tender, with expected prices of $600 FOB, however, may push the price higher still.

MOP

Granular MOP prices were mostly stable declining slightly to $320-$330 CFR. Year over year, MOP prices are down 13%.

Granular prices were supported by steady in-season demand from Brazil, but standard MOP prices continued to drift lower as the markets wait for new standard MOP contracts for India and China. The new contracts are expected to be priced at the $280 CFR level. The contracts should stimulate MOP demand and set a floor on prices.

There is still a large disconnect between SOP and MOP prices. With SOP exports restricted from China, supply is very tight in S.E. Asia. SOP is being offered in Thailand at $685 - $695 CFR partially due to higher freights. The $365 per ton premium is significantly higher than the traditional average price difference of $200 per ton.

Rice Fertilizer Program Approved

As reported on 26 June in the Bangkok Post, the Government has approved a budget of 29.9 billion Baht (USD $808 million) to reduce the cost of chemical and organic fertilizer for rice farmers. There are 8 fertilizer formulas included in the program including: Urea, 20-8-20, 16-20-0, and 16-8-8.

The program is targeted for the major or first rice crop grown in the third and fourth quarters. According to the Office of Agriculture (OAE) economics, Thailand harvests approximately 9.5 million hectares of land for the major rice crop with an average fertilizer application of 250-500kg per hectare.

Thailand consistently ranks as one of the top 5 rice exporters in the world and the government expects the program to increase this season’s rice production.

https://www.bangkokpost.com/business/general/2817700/cabinet-allocates-b29-9bn-for-fertiliser-scheme

The Changing MOP Market

The order is rapidly fadin'

And the first one now

Will later be last

For the times they are a-changin'

Bob Dylan

The Muriate of Potash (MOP) market has changed a lot in Thailand over the last 15 years. MOP contracts in the past have been limited to a select group of well-financed, major importers in any one country.

In 2013, the Uralkali and Belaruskali (BPC) coalition separated. The period briefly opened the market for new importers and changed MOP purchasing patterns.

Around 2017, SQM limited MOP production from Chili to focus on the more profitable lithium and potassium nitrate markets.

Belarusian authorities diverted a plane in May 2021 en route to Lithuania carrying journalist Roman Protasevich to Minsk. The incident had wide-reaching implications and led to sanctions against Belarus from many countries.

Soon thereafter, Lithuania terminated the railway transport agreement with BPC thus denying access to the port at Klaipeda. With exports restricted, BPC was forced to alter trade routes.

In February of 2022, the conflict between Russia and Ukraine commenced. Restrictions and sanctions soon followed on Russian potash. MOP trade flows were again disrupted.

In May of 2022, MOP was hitting new highs not seen since 2008. Prices reached $1,100 per metric ton CFR on supply tightness and port congestion from the aftermath of Covid-19.

Since October 2023, Dead Sea Works (DSW) and Arab Potash Corporation (APC) have had Red Sea transit routes disrupted by the conflict in Gaza. Cargoes diverted around the Cape of Good Hope have further increased logistics costs and port congestion worldwide.

As of 17 June 2024, the threat of unionized port workers at the Port of Vancouver currently looms over Canada’s largest port.

The Rise of Laos

One of the big stories in MOP is the emergence and growth of Laos. China has made substantial investments in Lao Kayuan and Sino-Agri Potash over the last 5 years. Both plants are in Khammouane province.

As Argus Media recently reported, Sino-Agri Potash will increase their capacity from 2 million tons per year to 5 million tons by 2025/26 and eventually 10 million tons per year. Lao Kaiyuan currently has a capacity of 1 million tons and plans to double that by the end of 2025. Deliveries to China have grown massively to 1.7m tons in 2023 from just 127,800 tons in 2020. (Argus Media, Insight Paper, May 2024, Laotian MOP supply boom: Key challenges and the need for a new Laos MOP price assessment).

Sino-Agri Potash Plant. MV Cheng Ji Hai. 1st Granular MOP Vessel from Laos to Thailand.

There are also three ongoing projects near the Laos capital of Vientiane which are funded with Chinese investment: Sino Hydro Mining (2.5m mt/year), Ruiyuan Richfield Sylvine Sole (500k mt/year) and Zangee Mining (2.0m mt/year).

In July 2023, we imported MOP from the first bulk vessel sent from Laos to Thailand, a 4,500 ton coaster from Cua Lo Port, Vietnam. Argus reported in May 2024 that Sino-Agri sent their first bulk vessel from Vietnam to Europe and this month sold their first bulk cargo (27,000 tons) of granular MOP to Brazil.

Two undeveloped MOP projects in Thailand (Chaiyaphum and Udon Thani) are currently being reviewed. Reuters recently reported that China’s SDIC (the largest SOP producer in the World) is looking to acquire 49% of the MOP mine in Udon Thani, Thailand.

With increasing supply from Laos, Eurochem and BHP’s Jansen project, there will be heightened competition, especially for importers that resell to smaller bulk blenders and manufacturers. Small plants in Malaysia will compact inexpensive Russian and Belarusian standard-grade MOP and export to Thailand via container. International traders will compete for MOP allocation from new manufacturers to the Southeast Asia markets.

The Sulphate of Potash (SOP) market will continue to grow in areas where soils accumulate too much chloride and growers learn more about chloride-sensitive crops. Agricultural byproducts, locally sourced high-quality minerals, and bio-waste projects that produce fertilizers with considerable soluble K2O content and low Chlorides will all compete as a K2O source.

For MOP times are certainly ‘a-changin’.

If MOP contains 60% K2O, what is the other 40%?

Canpotex Granular MOP

We are frequently asked this question. The chemical name for Muriate of Potash (MOP) is Potassium Chloride (KCl). However, the Chloride content is never listed on fertilizer bags.

If the chemical purity were 100%, the Potassium (K) would be 52.4% (63.1% K2O) and the Chloride (Cl) would be 47.6%.

However, the simple answer is approximately:

50% Potassium (as K) [ 50% K is equivalent to 60.2% K2O ]

48% Chloride (as Cl)

2% Magnesium (Mg), Calcium (Ca), Sodium (Na), Sulfates (SO4) and insolubles such as clay.

The logical next questions: Are Chlorides helpful or harmful to plants and soils and why isn’t the Chloride content listed on the bag?

Stayed tuned.

IFA 2024: A Glimmer of Hope

IFA 2024 Conference

The recent IFA fertilizer conference in Singapore offered a welcome change from the past two years of declining fertilizer prices. There was a positive and upbeat mood among attendees, suggesting a potential turning point for the industry.

Here are some key takeaways:

Prices for Potash (MOP) may have reached their bottom, with new contracts in India and China potentially setting a floor.

While demand remains sluggish, there are early signs of a pick-up, particularly in Southeast Asia where good rains are anticipated.

Uncertainty surrounding China's export policies remains a concern.

The issue of freight costs continues to be a challenge, with port congestion, high fees, and unpredictable cancellations adding to difficulties.

Despite these uncertainties, prices have firmed across the board since the conference. Urea is up $30 per ton, DAP $15 per ton, Ammonium Sulphate $10 per ton and MOP has been mostly stable to flat.

This cautious optimism suggests a possible recovery in the latter half of 2024.

Durian & Boron – How Much and When?

Always a great surprise for everyone in the office when a customer sends freshly harvested Durian. At retail prices of up to 1,000 Baht per kg, Durian can be very fruitful for the farmer as well.

A lot of farmers ask, how much boron should I use and when should I apply? It can be a complex answer without doing a complete soil test.

Good soil levels of available Boron are between 1.00 – 2.0 ppm and are deficient below 0.70 ppm. Due to the toxic nature of Boron and the fact that it is very mobile in the soil, raising soil levels of Boron can be tricky.

For mature durian trees (over 5 years) we recommend 1.6 - 2.4 kg per rai per year (80 - 120 g per tree) of Granubor® or Fertibor®, both of which contain 15% water soluble boron. Apply at the post-harvest and vegetative phases before flowering.

We also recommend using 200 grams of Solubor® (20.5% B) per rai as a foliar application up to four times during the growing season at the post-harvest, vegetative, and flowering stages. Solubor can be mixed and applied at the same time as your insecticide/fungicide.

“Even though soil and leaf tissue analysis usually show no B deficiency, fruit trees often have difficulty in transporting enough B to new flower buds,” says Dr. Timothy Righetti. “B is especially immobile in most plant tissues and will not readily move from other parts of the tree to the buds when it is needed for pollen tube growth, pollen production and other reproductive functions.”

“Under cool or otherwise poor growing conditions, flowers can deteriorate before fertilization is complete,” says Righetti. “Foliar B enhances fruit set in these situations by accelerating the fertilization process.” (‘Fruit tree foliar nutrient sprays’, RTM, U.S. Borax)

Some General Tips About Boron:

Many fertilizers and soil amendments contain boron and are a great way to ensure even distribution in the field. Be sure to ask about the B content as it may not be listed on the label.

Boron rates of application may need to be adjusted if you are applying with Lime or Dolomite.

Boron rates will vary based on the age of the tree. Fruit-bearing trees will require more boron.

Annual applications of boron are required as B is very mobile in the soil and immobile in the plant. Deficiencies will show up in new leaves and affect fruit quality, shape, and yield.

While Calcium puts the starch into the leaves, boron takes the starch out of the leaves and puts it into the fruit improving quality and size.

Good levels of organic matter and microbial activity will help with boron availability. Excess potassium in the soil will tie up boron.

Never use more than the recommended amount of Boron. Always consult your local agronomist for more information.